Original content provided by BDO United Kingdom

1 in 10 UK mid-market businesses are at risk of becoming a so-called ‘Zombie’ – businesses must act now.

- ‘Zombies’ are companies that generate just enough cash to continue operating and service their debt but not to invest in growth

- There is growing concern that historically low interest rates have been enabling underperforming companies to limp on without being forced to restructure. Is the UK’s mid-market full of ‘Zombie’ businesses?

- BDO analysis shows that, whilst a minority of mid-market businesses meet a generally accepted definition of being a so-called ‘Zombie’, the number of firms ‘at risk’ is still significant

- Having analysed businesses in the £10m to £500m turnover bracket, we found that of the 16,000 businesses reviewed just over 1 in 10 could be deemed ‘at risk’ of being or becoming a ‘Zombie’

- Companies that are currently at risk with low profitability and high debt burdens need to address their resilience and take action.

The combination of high inflation, rising interest rates, geopolitical instability, Brexit and COVID-19 has impacted the UK economy in an unprecedented manner. These issues, together with the energy crisis, have all weighed on business confidence, investment and consumer spending and will likely continue to do so well into 2023 and beyond.

BDO’s latest business trends analysis highlighted that output and optimism indices fell to their lowest levels since the third national lockdown in February 2021, now sitting in contractionary territory.

As such, there is sentiment that the UK mid-market is likely to face an increasingly challenging environment from the combination of a tumultuous demand-profile, declining output, significant increases in balance sheet liabilities and increased debt burdens.

In this article we assess the number of firms within the UK mid-market at risk of being so-called ‘Zombies’, but more importantly, we explore what those vulnerable companies and management teams could be doing to limit damage and build resilience into their operating model.

What is a ‘zombie company’?

‘Zombies’ are companies that generate just enough cash to continue operating and service their debt but not to invest in growth. In the current economic climate, there is growing concern amongst commentators that historically low interest rates have been enabling underperforming companies to limp on without being forced to restructure.

These low interest rates and the potential willingness of lenders to show forbearance to unprofitable companies is said to be damaging productivity and undermining competitiveness.

The above, coupled with high inflation eating away at margins and testing what are historically sound business operating models, is resulting in reduced confidence, weakening recovery plans and, importantly, is testing the resolve of lenders.

Navigating this landscape will be a challenge and restructurings are likely to be common. This will not only impact jobs in individual firms, but it will also affect businesses in the interconnected supply chain and local economies.

Despite the challenging environment, there will be an opportunity for strong and well-run businesses to consolidate their market positioning, embed resilience and take advantage of a fragmented outlook.

How many companies are at risk?

Historically, highly profitable businesses are more able to withstand longer periods of reduced revenue as they are likely to be cash generative with strong balance sheets. This would prime them to remain resilient to any potential downturn.

There is a concern however, that because of an extremely challenging environment over the last five years, the number of UK mid-market companies at risk of being a so-called ‘Zombie’ is growing.

BDO analysis shows that, whilst a minority of mid-market businesses meet a generally accepted definition of being a so-called ‘Zombie’, the number of firms ‘at risk’ is still significant.

Having analysed the mid-market – businesses in the £10m and £500m turnover bracket – we found that of the 16,000 plus businesses reviewed, just over 1 in 10 could be deemed ‘at risk’

We define ‘at risk’ to be businesses that have both:

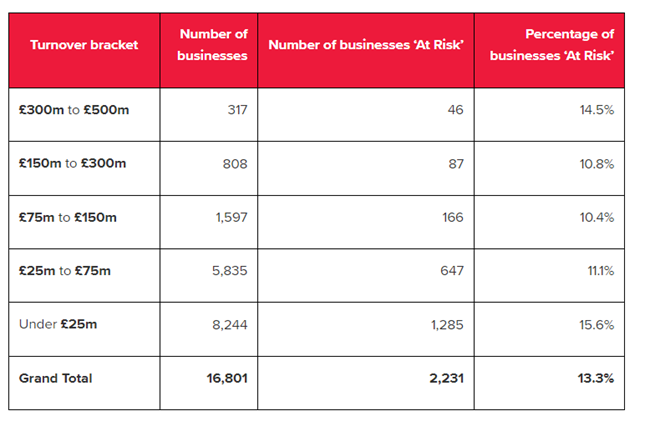

The analysis showed that whilst all revenue bands had over 10% of businesses ‘at risk’, smaller businesses were more exposed than those in higher bands.

Of the 2,231 businesses identified to be ‘at risk’ in the UK mid-market, the majority were either larger £300m - £500m turnover corporates, or smaller businesses with turnover under £25m.

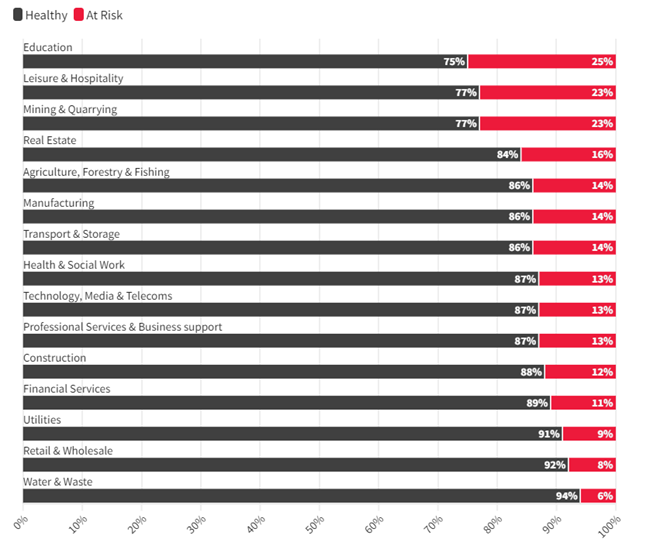

As expected, some sectors are also more exposed than others. The graph below plots the percentage of ‘at risk’ businesses in some key sectors:

Education is shown to be the sector facing the most challenges. This likely reflects a number of issues providers of education are facing, given rising costs and a fairly stable income base. Within the dataset, a high proportion of organisations are already displaying losses and deficits in their most recent financial year.

In the context of a large number of these organisations being limited by guarantee, largely funded by government and being not-for-profit, this is less alarming than in most sectors. However, the issue remains that management teams in this sector need to monitor their institution’s resilience and ensure plans are in place to counter consistent and sizeable deficits.

Leisure & Hospitality businesses also display significant signs of distress – a trend business owners are telling us is due to numerous lockdowns, tumultuous demand, staff shortages and increases in company debt payments as a result of higher borrowings.

Retail & Wholesale displays a lower percentage of ‘At Risk’ businesses - possibly lower than might be expected. However, within the sector there is a significant variance between wholesale businesses (8%) and retail (12%) businesses, who have likely faced different challenges of late.

The sector grouping is also potentially masking variations between physical presence retailers and online retailers, together with the variance between those that sell necessity products versus those that sell non-essential goods.

Utilities and Water & Waste sectors appear fairly resilient, which is likely due to reduced impacts from the pandemic and robust demand profile.

Business turnaround: what do at risk firms need to do?

Whilst our analysis shows the number of firms ‘at risk’ may be lower than expected, there is still a significant minority that may not be well-positioned to enter choppy waters. Companies that are currently at risk with low profitability and high debt burdens need to address their resilience and take action.

The strength of company balance sheets often depends on the level of funds shareholders have taken out as dividends, the amount of debt taken, or the amount invested in new products and assets. This will impact a company’s options and the time available to implement changes or turnaround actions.

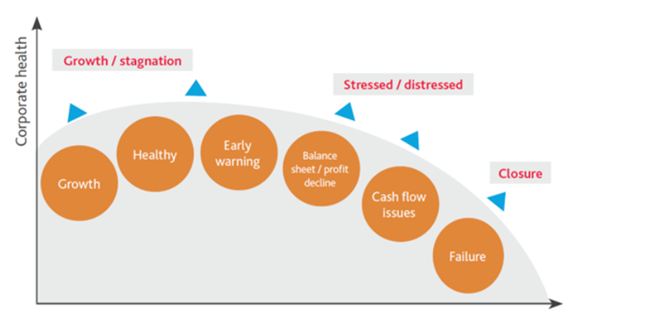

It is likely that most ‘at risk’ businesses will have reluctantly moved further to the right on the corporate decline curve as a result of recent economic challenges – see chart below.

In general, businesses responded well to the impact of geopolitical tension, COVID-19 and Brexit. They focused on minimising the effects on business operations by reducing costs, preserving cash, seeking additional funds to plug short-term funding gaps and implementing necessary health and safety measures to ensure employee safety.

However, most businesses will require more transformational action to ensure they can prime themselves to survive the coming economic turbulence. We highlight below some of the short-term actions that we have advised clients to implement. Addressing these issues now has been fundamental to a business’ longer-term health and protecting shareholder value.

Short Term Actions

- Rigorously challenge the cost base – attempt to eliminate non-essential expenditure and implement processes and controls to discourage needless spend

- Assess product/service mix and reduce focus and management time spent on weaker products and services

- Undertake a rapid assessment of the business’s pricing strategy – optimised pricing is the quickest way to bottom line improvement. Consider segmenting your customer base, focussing on 80/20 principles, and making use of targeted discounts and promotions

- Consider mothballing production assets and sites that offer little contribution but add complexity

- Challenge the organisation structure and, if appropriate, reduce headcount costs through short-term working and laying off

- Comprehensively challenge usefulness of time-consuming tasks and reporting, ceasing those which add little value

Numerous companies are hoping that a downturn may be short lived and governmental measures will support the economy. However, with the risk that a potential downturn may be prolonged, for ‘at risk’ businesses to survive in the medium to long term, more fundamental actions are likely to be required.

Below we highlight some of the actions we encourage businesses to take to implement more structural, permanent changes to their business operating models.

Implementing one or a combination of these actions requires a business transformation programme and it is likely that management teams will require additional support to define, plan and implement agreed actions. Additional or alternative funding may also be required to finance the business transformation.

Medium Term Actions

- Downsize the organisational structure in operational and back-office functions. This would involve eliminating roles, de-layering management levels and merging functions to reduce the number of staff in the business

- Assess the intellectual property or technical transfer your business’ products or services provide. This could involve ceasing the production of non-core or low value products, and investing in new products and services in more resilient and profitable business sectors

- Restructure the business by closing sites or locations. This could involve exiting UK and international factories or offices and consolidating production locations, as well as assessing the impact of the exit from the EU

- Challenge all back-office processes and consider levels of automation vs manual activity, quality of output, and identify core process weaknesses

- Undertake a comprehensive review of your finance function and its potential weaknesses. This can help to dramatically improve cashflows. Businesses that are struggling may have to become imaginative with ways of dealing with current cash, credit and debit balances (such as considering debt factoring, offering customer incentives, following up with invoice reminders)

- Insource production or services from sub-contractors. This could utilise spare production capacity within your existing manufacturing footprint

- Periodically prune your business by divesting slow-growing parts and reinvesting the proceeds into new areas. For companies that do not see consistent growth, trying to boost performance with a one-time large acquisition should be discouraged

- Divest underperforming business areas, or wind them up if they are not sellable. This would allow your business and management team to focus on more profitable operations

- Consolidate and de-risk your supply chain. This would involve reducing suppliers to maintain volumes with a smaller number of key suppliers, and relocating the supply base closer to home to reduce the risk of supply interruption

- Acquire businesses and integrate operations to boost turnover and profitability. This would boost scale, productivity and allow significant savings

- Consider the provisions of the CIGA to protect your business from creditors whilst a turnaround plan is implemented.

The restructuring provisions within the recently introduced Corporate Insolvency and Governance Act 2020 (‘CIGA’) are a welcome addition to already available restructuring tools, especially as these are debtor-led, allowing the company to control the restructuring process. These new tools grant businesses a level of moratorium protection as they navigate their way out of the current environment. However, the use of these protections requires early intervention to allow time to create a viable financial and operational restructuring plan.

Although the current economic environment is having a significant impact on the mid-market, we would suggest that companies should respond positively to the challenges and use instability as a catalyst for change, and an opportunity to build resilience into their operations. Many of our clients have already embarked on this journey and are actively in the process of reshaping their businesses.

If you would like further information, contact Brian Murphy, Michael Jennings or John Young.