Quarterly Economic Survey: Q3 2021

20 October 2021

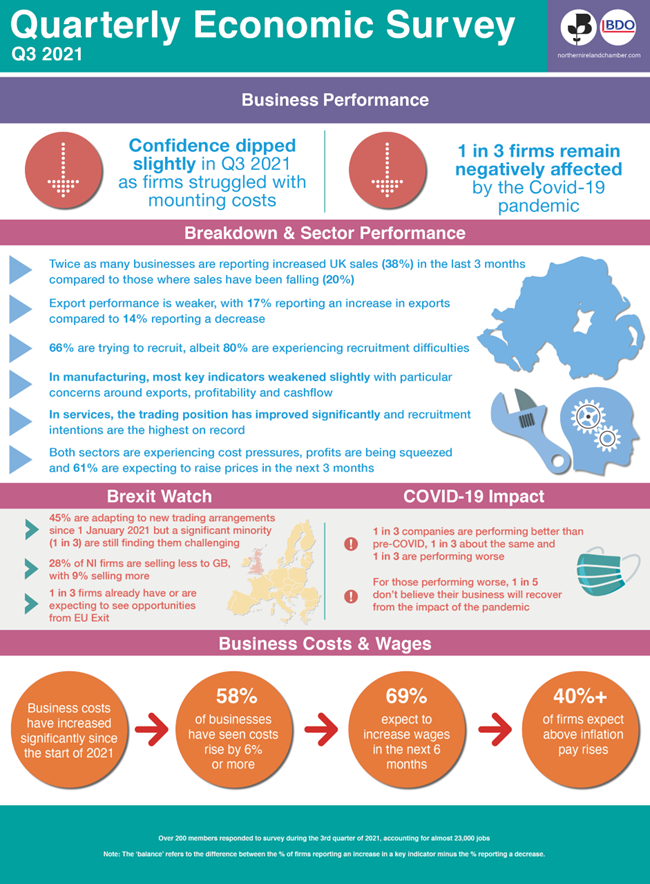

The Q3 21 QES findings suggest that while there are still positive signs of recovery in the Northern Ireland economy, inflationary pressures from mounting business costs and labour availability are knocking business confidence around prospects for growth going forward. After reaching record lows across all key indicators in Quarter 2 2020, 18 months on since the pandemic struck most key indicators around domestic sales, exports and jobs have continued to show signs of improvement. In total, 8 out of 11 key indicators in manufacturing are positive and all of the 11 in services in Q3 21. The share of businesses operating at full capacity did fall slightly over the quarter to 39% (44% Q2 21) for manufacturing but increased to 47% (43% Q2 21) for services in Q3 2021. Recruitment activity is strong but more businesses are finding it difficult to get staff. Inflationary pressures are building with raw material costs, wage increases and COVID and EU exit pressures among the many factors driving rising business costs.

The Northern Ireland economy was already in a fragile position entering the crisis according to previous QES findings. However, COVID-19 has caused the worst QES performance on record. The immediate impact of COVID-19 has been much greater than the aftermath of the financial crash in

2008/09.

The recovery has been stronger in the domestic (UK) economy compared to export markets. In Q3 2021 38% saw an increase in domestic sales (Q2 21 34%) over the last 3 months, UK sales remained constant for 42% of members (Q2 21 42%) while 20% of businesses experienced a fall in domestic (UK) sales (Q2 21 24%). The export recovery has been weaker and in Q3 21 the manufacturing balance became negative meaning more businesses making lower sales outside the UK. Employment indicators have not been as badly impacted reflecting the role of the job retention (furlough) scheme intervention in buoying

up employee jobs. The service sector had a particularly strong employment performance in Q3 21, in part reflecting the easing of many of the restrictions that were in place due to the pandemic.

In total. 215 members responded to the NI Chamber of Commerce & Industry Quarterly Economic Survey (QES), in partnership with BDO, for the 3rd quarter of 2021. Together they account for over 31,000 jobs in Northern Ireland.

The fieldwork for the Quarter 3 survey took place between 26th August and 14th September 2021, 18 months into the COVID crisis during a period when almost all COVID restrictions were lifted. This was also 8 months into the beginning of new trading arrangements coming into place on the 1st January 2021 following the end of the transition period post-Brexit.