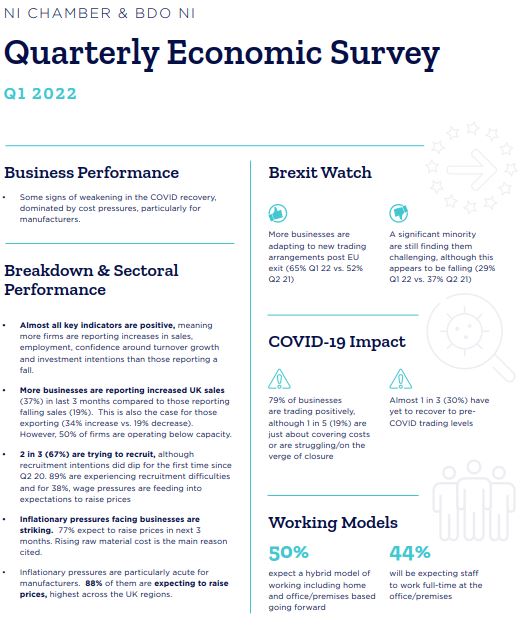

There were some signs of weakening in the COVID recovery path for Northern Ireland businesses in Q1 22 dominated by huge cost pressures, particularly for manufacturing, weakening cash flow and profitability and putting firms under growing pressure to raise prices.

The Q1 22 QES findings suggests that members are less confident around turnover growth over the next year with 60% expecting their business turnover to grow in 2022, down from 70% in Q4 21. Inflationary pressures from mounting business costs, largely from high raw material costs but also pressure to raise wages, are causing significant concern with manufacturers particularly affected. Expectations to raise prices are highest on record with a greater share of businesses in Northern Ireland expecting to raise prices in the next 3 months compared to all other UK regions.

After reaching record lows across all key indicators in Quarter 2 2020 with the onset of the COVID-19 pandemic, 2 years on almost all key indicators are positive meaning more firms are reporting increases in sales, exports and employment than those reporting a fall. By comparison one year ago in Q1 2021 almost all key indicators were negative. More businesses are reporting increased UK sales (37%) in the last 3 months compared to those reporting falling sales (19%). This is also the case for those exporting (34% increase vs. 19% decrease).

However, there are still challenges with 50% of businesses operating below capacity (52% Q4 21). Also, in Q1 22 30% of firms still remain negatively affected by the pandemic and 19% are just covering costs or are in difficulty. EU exit has also presented a new set of challenges over the last year with many businesses affected by increased costs.

Two in 3 (67%) are trying to recruit (although recruitment intentions did dip for the first time since Q2 20). However, 89% are experiencing recruitment difficulties and for 38% wage pressures are feeding into expectations to raise prices.

The most striking issue in Q1 22 is the extent to which inflationary pressures are impacting on businesses, particularly manufacturers. 77% expect to raise prices in the next 3 months driven in large part by high raw material costs. Almost 4 in 5 (77%) cite rising raw material costs as the main driver of price rises. Cash flow and profitability for manufacturers is particularly negatively affected.

In total. 215 members responded to the NI Chamber of Commerce & Industry Quarterly Economic Survey (QES), in partnership with BDO, for the 1st quarter of 2022. Together they account for almost 27,000 employees in Northern Ireland.

The fieldwork for the Quarter 1 survey took place between 17 February 2022 and 4 March 2022. This is just over one year since the introduction of the Trade and Cooperation Agreement and Protocol. All COVID restrictions in Northern Ireland were lifted on the 15th February 2022. The war in Ukraine was officially confirmed on the 24th February 2022.