Pensions – protecting your lifetime allowance

09 March 2022

The Lifetime Allowance (LTA) is the maximum an individual can hold in a pension fund without facing penal tax charges when taking pension benefits. This concept was introduced as part of major reforms to tax relief for pension in April 2006 with the limit set at £1.5m – before then there was no value limit on tax-advantaged pension pots.

To avoid penalising individuals who had already built up with large pension pots, they were allowed to protect themselves from an excess charge on their pension funds by applying for ‘primary’ or ‘enhanced’ protection (depending on their circumstances and the values of their funds). By April 2012, the LTA had reached £1.8m and the Government decided to reduce it – and there have been several other reductions since then. Each time the Lifetime Allowance has reduced, the Government has allowed individuals to protect their exiting LTA entitlements by opting for ‘protection’.

Fixed and enhanced protection can be lost if additional contributions are made or pension input accrues to the individual. Care must therefore be taken to ensure additional contributions are not made, for example due to auto-enrolment when starting a new job. In April 2022, changes to public sector pensions schemes create the risk that many individuals will be automatically enrolled and lose their fixed and enhanced protections unless they opt out.

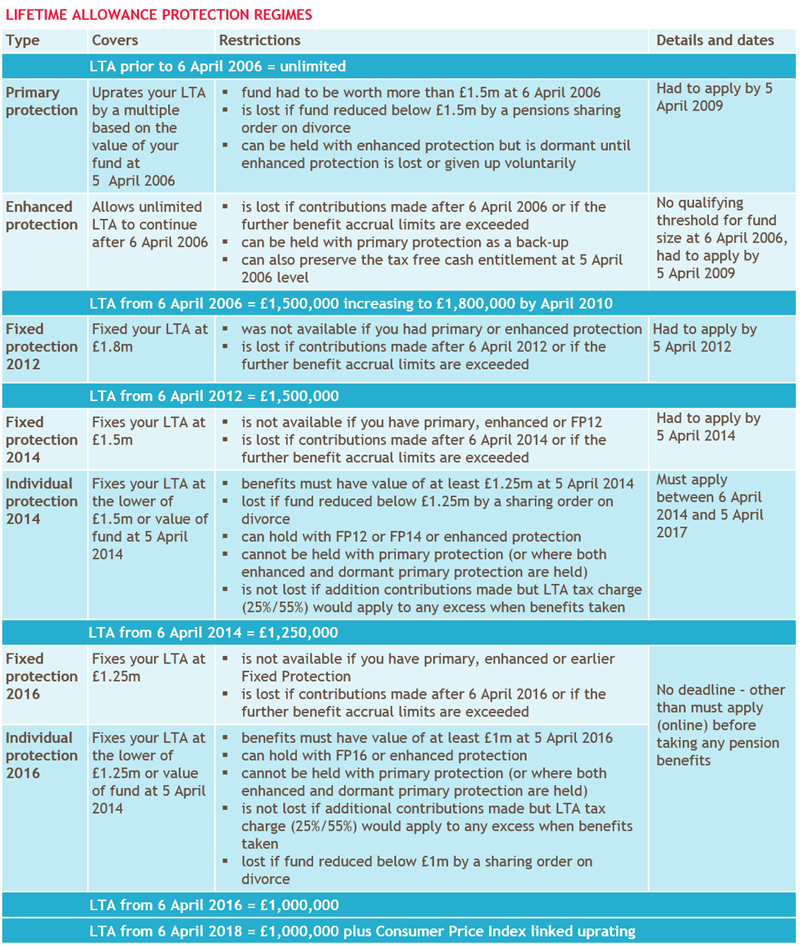

The table below sets out the different protection options and requirements.

If you have any questions on the tax position on your pension pot, please get in touch.