There are lots of happenings this year in the VAT and other indirect taxes space.

In particular, there are changes from the start of 2023 regarding penalties for late submission of VAT returns and/or late payments of VAT. While some of the other changes will impact organisations across the board, others are limited to importers of goods.

We have outlined an overview of the forthcoming changes and the key dates you should be aware of below:

1 January 2023

For VAT periods starting from 1 January 2023 onwards, the old default surcharge regime is gone and a new ‘driving licence’ style points-based regime begins.

All businesses will begin with a ‘clean slate’ in respect of VAT late filing and payment penalties.

Whilst the new regime is rolled out, HMRC have confirmed some leniency and so the daily penalty for late payments (under 30 days) throughout 2023 will not be charged.

Late VAT returns

The new penalty points system for late VAT returns, is intended to be less punitive where the taxpayer misses the occasional deadline, compared to the surcharge regime that could lead to large penalties for relatively minor errors made by taxpayers.

HMRC will allocate a taxpayer one point each time a filing deadline is missed and similar to driving licence ‘points’, your points for late returns will expire after two years unless you go over the penalty thresholds.

For example, a taxpayer with the quarter ended 31 March 2023, with a filing deadline of 7 May 2023, submits their VAT return on 8 May 2023, would be allocated a point for missing their filing deadline.

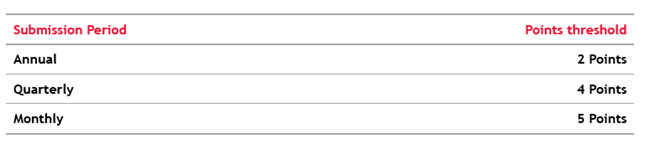

A fixed £200 penalty will be charged once points exceed 2,4 or 5 (depending on the reporting cycle) and all subsequent missed deadlines will trigger a penalty.

Penalty Points

A penalty will be charged when your total exceeds these thresholds:

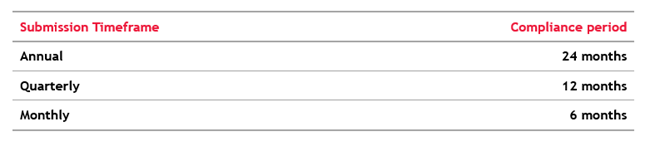

Resetting the points clock after a penalty

To reset the clock you have to meet a longer test of good compliance (i.e. submitting everything on time) for a specified period which depends on your return cycle as below:

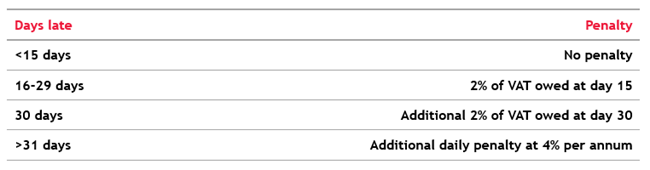

Late VAT payments

The points-based system does not apply to late payments of VAT owed to HMRC, rather in two stages, fixed penalties and daily penalties.

Interest will continue to be charged from the VAT liability due date at Bank of England base rate plus 2.5%

Interest will continue to be charged from the VAT liability due date at Bank of England base rate plus 2.5%

Avoiding a penalty

Obviously, filing returns and paying VAT on time is the best way to avoid extra costs. However, if you can’t afford to pay your VAT bill, it is still best to file your return on time and approach HMRC for a Time to Pay Agreement.

15 March 2023

Spring Budget

The Chancellor of the Exchequer will provide an update on Government finances and proposals for changes to taxation which may contain updates in respect of VAT and other indirect taxes. While new duty rates usually come in on the 1 February each year, the government has indicated that this year decisions on duty rates will be deferred until the Spring Budget on the 15 March 2023.

1 August 2023

Alcohol duty reforms

The duty structure for alcoholic products is to be amended to a standardised series of tax bands based on alcohol by volume. Any business involved in manufacturing, distributing, holding or sale of alcoholic products is likely to be affected and should take steps to ensure the impact of changes is understood and any necessary changes are made.

There will also be two new reliefs and a temporary easement being introduced alongside these reforms.

30 November 2023

Customs Declaration Service- CDS to become sole customs platform

The use of HMRC’s long-standing customs platform, CHIEF, came to an end for import declarations on 30 September 2022 and was replaced by CDS.

The use of CHIEF for export declarations will end on 30 November 2023 (having been pushed back from 31 March 2023) and exporters still using CHIEF should take steps ahead of this date to ensure that they are ready and able to make declarations via CDS instead, given the potential disruption to their supply chains.

31 December 2023

Safety and Security Declarations

Having left the EU, the UK has delayed the requirement to complete Safety and Security Declarations in respect of goods imported from the EU. However, this is expected to end on 31 December 2023. Businesses will need to be preparing in advance of this to ensure they have the capacity, resources, and knowledge to provide the information required to the carrier.

Trader Support Scheme potentially ending

The TSS was set up to assist taxpayers with understanding the rules applicable to the movement of goods between Great Britain (GB) and Northern Ireland (NI) and to provide a portal for customs declarations to be made for the movement of goods between GB and NI. It provides support, guidance and training, including assistance with the completion of import and safety and security declarations. The TSS has been extended to the end of 2023; however, businesses should make plans for the system to end on this date.

End of retained EU law

Under the current wording of the Retained EU Law Bill, most remaining EU derived law in the UK (a major example of which would be the VAT legislation) will be repealed unless a specific decision is taken by ministers to retain individual pieces of legislation. There is potential scope for changes to occur to the laws governing UK VAT, which have so far been left largely untouched since Brexit.

If you would like further information, don't hesitate to contact our Tax team: Maybeth Shaw, Lorraine Nelson.